21 May 2018

The £20,000 Survey: What would you spend it on?

Twenty thousand pounds is a considerable sum of money for most people. Roughly the value of the average house deposit (outside of London), there is little in our lives an injection of this amount of capital wouldn’t improve drastically. What the public would choose to spend it on was something we were curious to know, so we commissioned a YouGov survey to find out more. Here are the results!

Britain:

- Almost 5 in 10 British people would consider using an additional £20,000 by putting it into savings.

- Just over 4 in 10 would be willing to spend the money on a holiday or travelling.

- Over 3 in 10 would consider putting it towards home improvements

Our survey found that just a shade under half of British people would put an additional £20,000 to use by putting it into savings. Whether to cover children’s university fees when they grow older, help family with incidental costs later down the line or just to sit and mature for a rainy day, it’s clear that the population still has a healthy appetite for saving, despite the fact that as a nation we are putting away less than at any time in the last 50 years. While rising living costs and a widening range of financial obligations have created more challenging conditions to putting aside larger amounts of funds, the results indicate that saving per se remains an attractive choice.

That said, only 6% fewer (43%) of the Brits we asked also indicated an interest in putting the additional £20,000 to more frivolous use by way of a holiday or travelling. With that amount of budget to hand, options could include a year-long sabbatical backpacking across several continents, a more luxurious round-the-world cruise or a whirlwind action packed week-long city break for friends and family. For our money, a series of shorter trips spread out over a number of years would be an ideal balance, but who are we to say!

The next most popular choice for the nation as a whole was home improvement, with a little over three in 10 of the survey responses expressing interest in ploughing a sizeable cash injection into making their house an even better home. Considering that you could carry out all of the top 10 home improvements in the UK for a little over £21,000, it would appear that our lump sum in question would allow for a thorough overhaul of many types of property and maybe make a few long-standing dreams of a new kitchen, updated bathroom or redesigned garden come true.

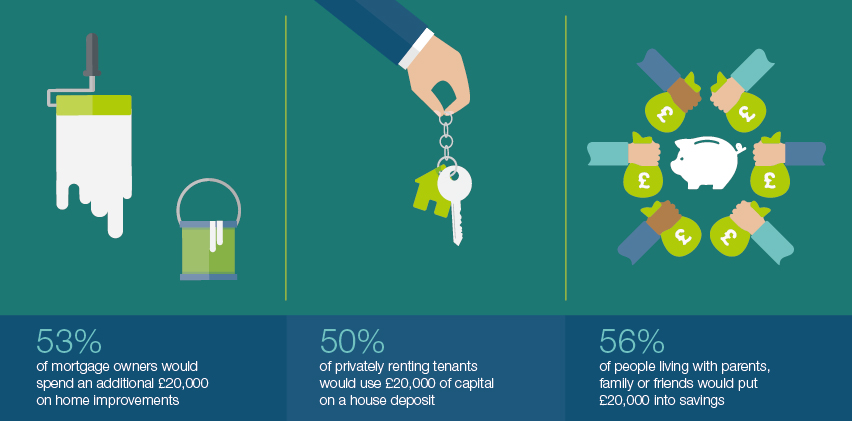

Mortgage v Renting

- 53% of mortgage owners would consider spending a £20,000 lump sum on home improvement.

- 50% of privately renting tenants would be willing to put it towards a house deposit.

- 56% of people living rent free with parents, family or friends are likely to use an additional £20,000 by putting it into savings.

Perhaps unsurprisingly, our survey found that the majority of mortgage owners would put a £20,000 lump sum towards improving their homes, clearly by virtue of the fact that they have a fixed abode to call their own and stamp their personality on. The challenge of saving enough to afford a deposit is ever-growing nowadays but once this initial hurdle is overcome, it’s only natural that the desire to improve living spaces doesn’t take long to come to the fore.

Even less surprising is the result that exactly half of those who currently rent from a private landlord would put the lump sum to use as a deposit on a house – precisely so they can stop renting. It has been well reported how there is often little difference in the outlay between an average monthly mortgage and typical rental costs but simultaneously renting and saving is often unfeasible or could take the best part of 10 years. A cash injection of this size would undoubtedly help people get around this complication of modern life and get a foot on the property ladder.

One interesting statistic was that the majority of people living with parents, family or friends – and paying some or no rent – would put the £20,000 into savings. Perhaps the relative security of such living circumstances means the overall outlook of this demographic is one of planning for the future in general, rather than looking to achieve something specific like buying a house or investing in a particular sector.

Yorkshire v London:

- Yorkshire is 30% more likely to spend the £20,000 on home improvements

- Londoners are 38% more interested in investing

- Yorkshire is 69% more likely to purchase a car with the additional £20,000

Being the proud northerners that we are, we couldn’t resist making a few comparisons between us folk of God’s Own Country and the responses from the population of the capital. As it happens, it turns out we’re especially proud of our homes to the point that we’re 30% more likely to spend the additional £20,000 on domestic improvements than our compatriots down in the Big Smoke. It could be down to a higher rate of rental tenancy in London, where house prices as undoubtedly way above the average and mortgages inherently much less accessible in relative terms than in the north.

Our survey also found that Londoners are 38% more likely to make investments with the lump sum, reflecting London’s status as the financial capital of Europe. Whether those in the UK’s largest city are savvier in terms of investments or simply have a clearer idea of where they want to invest their money, the results imply that Yorkshiremen and women prefer to keep their money closer to home.

Another example of this is demonstrated by the fact that people from Yorkshire are a massive 69% keener on spending our hypothetical £20,000 on a shiny new car. Our interpretation of this is that the larger distances and less comprehensive public transport system compared to London means a car is more of a necessity for people wanting to get out and about. After all, we have the Dales and Peak District national parks to call our own, and who wouldn’t want to pay them a visit?

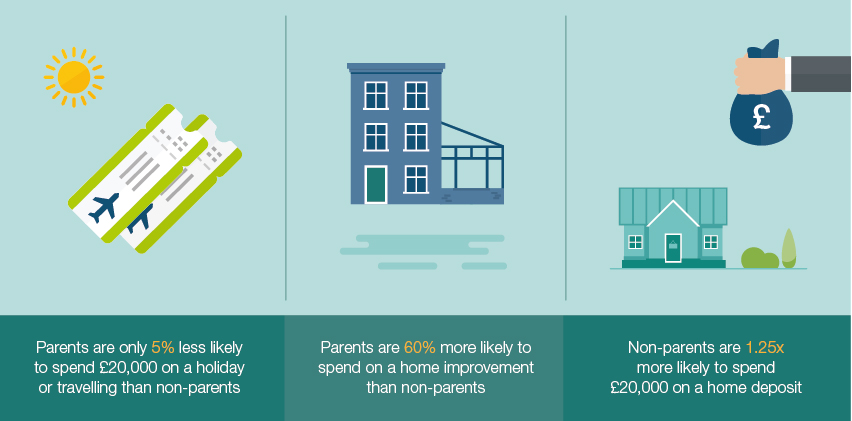

Parents v Non-parents:

- Parents 60% more likely to spend on home improvements

- Parents are only 5% less interested in using the £20,000 on a holiday or travelling

- Non-parents almost 1.25x more likely to spend it on a house deposit

Lastly, we compared the two data groups of parents and non-parents which revealed to us primarily that that people with children would be a full 60% more intent on spending their £20,000 on home improvement.

It’s easy to assume that a higher number of parents may already be home owners – such are the common stages of life we go through – whereas non-parents may not yet have that property in their name to modify to their liking.

Similarly, non-parents are 1.25x more likely to put the money to use by putting a deposit down on a house; perhaps stepping out of the private tenancy world and getting the keys to their very first home as a legal owner.

The last figure of interest concerned holidays: it transpires that despite the extra responsibility (both logistical and financial) parents are only 5% less interested in spending £20,000 on a holiday or travelling than those without children. It just goes to show how everybody needs some quality relaxation time away in the sun, kids or no kids!