23 November 2020

What is a market value reduction?

A market value reduction or ‘MVR’ is designed to protect members who are not taking their money out of the Society during adverse market conditions and ensures that all members receive their fair share of the with-profits fund.

An MVR reduces the amount of payout you receive when withdrawing your monies during exceptional circumstances.

You will only see the effect of an MVR should you wish to withdraw your monies at the time there is an MVR in place. An MVR can be added, removed, increased or decreased at any time.

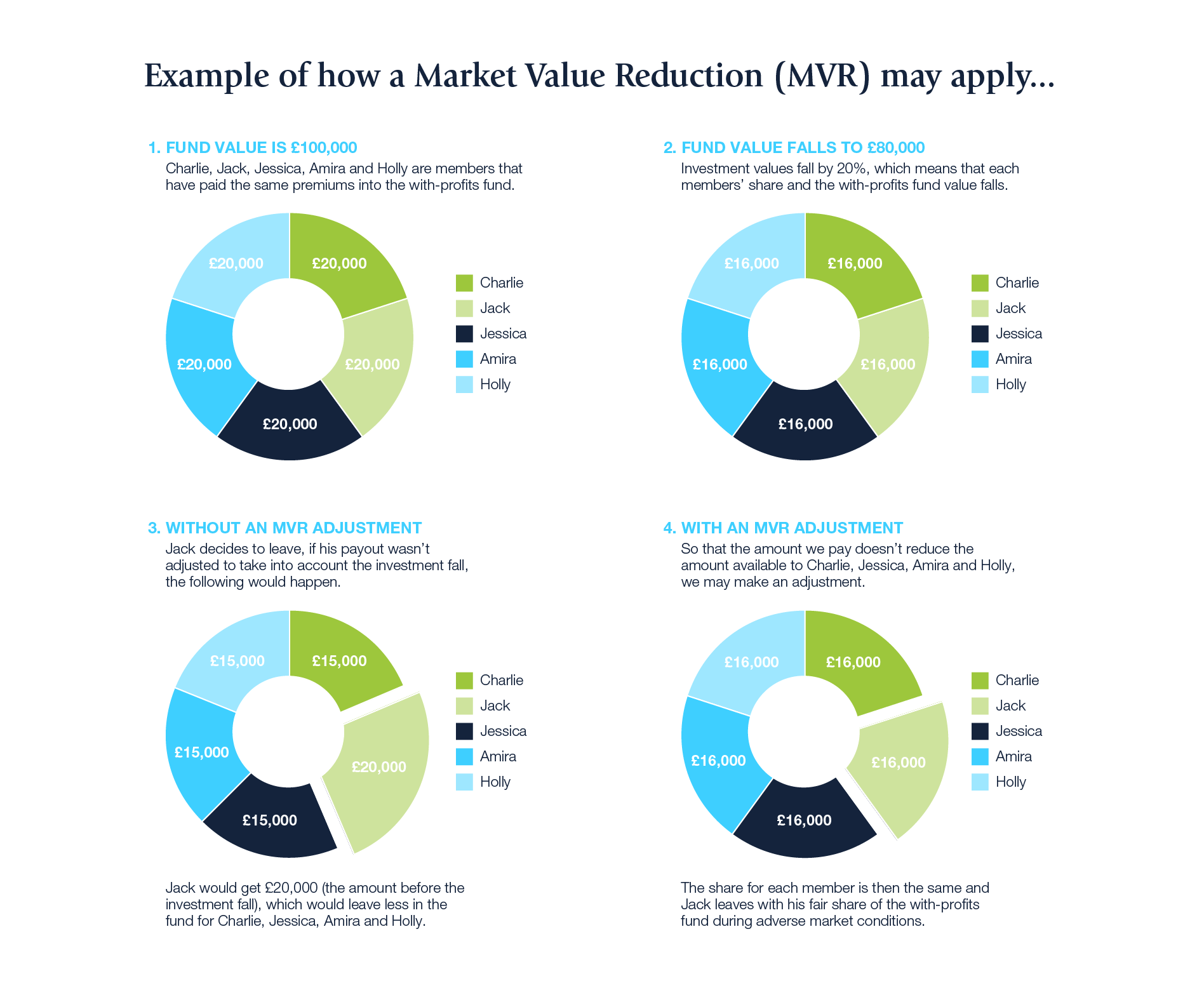

An example of how a market value reduction could be applied

Why/when is an MVR applied?

An MVR is only applied in exceptional circumstances and is implemented as a last resort.

An MVR may be applied during extreme market conditions such as those due to the current global Covid-19 pandemic, and is used to bring the overall payout of a withdrawal or surrendered policy closer to the asset share when the underlying value of the assets in our fund is lower.

We do this to:

- Protect the remaining members by making sure that a fair share remains

- Ensure the surrender value of a policy is not unfairly higher than the market value of the assets in the fund; at the time it is withdrawn

2020 is the first time in the Society’s history that an MVR has been applied it was due to Covid-19 and was fully removed at the end of July. During this period, the MVR was constantly monitored and updated accordingly.

When might an MVR be applied and on which plans?

An MVR may be applied to bonds'

- On maturity (any time after five years)

- A full surrender (before five years)

An MVR may be applied to an Investment ISA on:

- A partial surrender (withdrawal)

- A full surrender

- Transferring to another provider

An MVR may be applied to a Junior ISA** when

- Transferring to another provider

*Sheffield Mutual bonds have minimum guarantees despite MVR.

Investment Bonds: we guarantee to pay out a minimum of 103% of the initial investment after five years, regardless of any MVR.

Income Bonds: The Society guarantees that the application of an MVR after five years will not reduce the proceeds below the capital balance (the initial investment less income and partial withdrawals).

**Junior ISA: The Society guarantees that, providing the premiums have been invested for more than five years, you will get back a minimum 100% of the premiums in the event of a death or terminal illness claim or on maturity of the policy at age 18.

How do I know if an MVR is in place?

You will be notified if an MVR is in place if you ask for a surrender value, request a partial withdrawal or wish to close your plan when one is in place.

There is currently no market value reduction in place.