25 September 2021

A quick guide to the Investment Bond

- Invest a lump sum between £1,000 - £150,000

- Guaranteed minimum return of your original investment plus 3% after five years

- Bonuses are calculated based on the guaranteed amount

- Money is invested in our managed with-profits fund

- Open ended term – a surrender penalty will apply if you cash in the policy in the first five years

- You cannot make withdrawals from this policy, if you want to take an income from your investment please have a look at our Income Bond

If you surrender in the first five years a surrender penalty will apply, meaning you may get back less than you invested. Tax treatment depends on individual circumstances and may be subject to change in the future.

Bonuses are not guaranteed and depend on the performance of the with-profits fund.

Great growth potential and peace of mind for your investment

We invest in a range of low to medium risk assets with the aim of providing higher returns than would be achieved with a bank or building society.

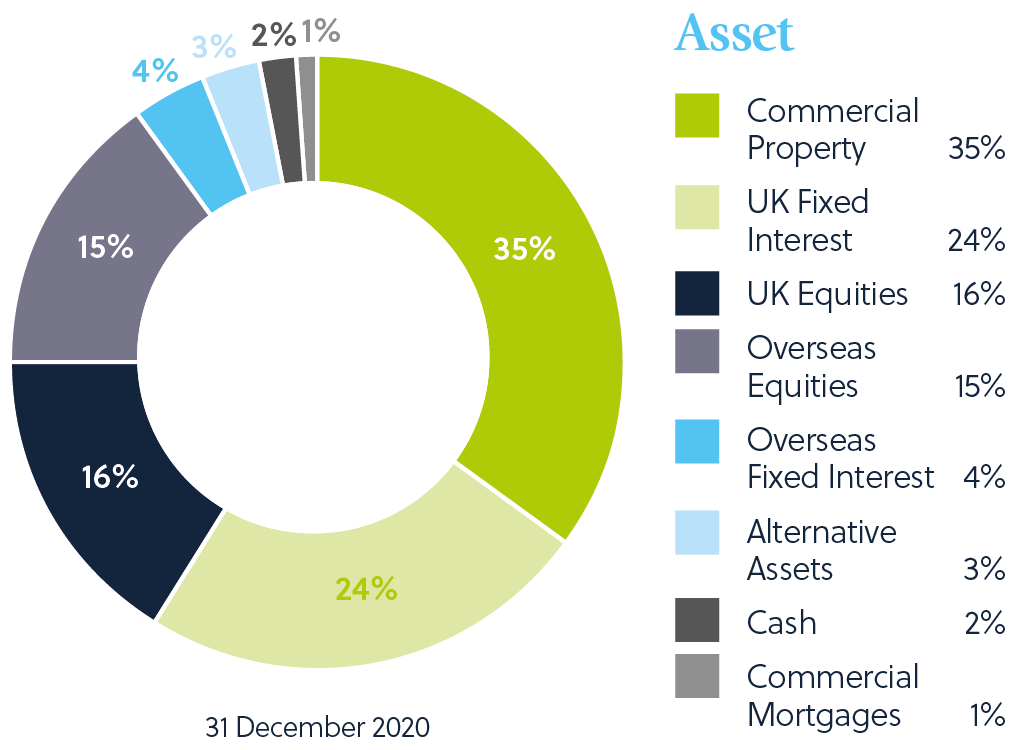

You can see where we invest your money below:

We suggest a minimum term of five years, otherwise an early surrender penalty may apply and you could get back less than you invested.

Bonuses are not guaranteed and depend on the performance of the with-profits fund.

This is intended as a quick guide to the Investment Bond. Please read the product brochure and Key Information Document should you wish to apply.

This blog provides generic information and opinions of the writer and should not be relied upon for making investment decisions. No advice has been provided by Sheffield Mutual. If you are in any doubt as to whether a savings or investment plan is suitable for you, you should consider contacting a financial adviser for advice. If you do not have a financial adviser, you can get details of local financial advisers by visiting www.unbiased.co.uk or www.vouchedfor.co.uk . Advisers may charge for providing such advice and should confirm any costs beforehand.